Company Renews Focus on eminent - Margin Revenue Streams and Owned & Operated Properties and Strengthens Balance Sheet for 2024 ; sales agreement of Complex Marks an Important Milestone for BuzzFeed , Inc.

NEW YORK – ( March 25 , 2024 ) – BuzzFeed , Inc. ’s ( “ BuzzFeed ” or the “ Company ” ) ( Nasdaq : BZFD ) fourth quarter and full yr ( end December 31 , 2023 ) fiscal results were in crease with its retool lookout shared in February , but fell brusque of its initial expectations . Looking in advance , following key strategic organizational variety , BuzzFeed is optimistic about 2024 with a commitment to high - tolerance revenue streams and a renewed focusing on its owned and operated websites and apps .

“ Three months into 2024 , it ’s exculpated BuzzFeed and digital medium are at an inflection peak , ” saidJonah Peretti , BuzzFeed Founder & CEO.“We’ve reconstitute our business to focus on our scalable , high - margin , and technical school - led revenue streams . We are leveraging AI tools to optimise our owned and operated platforms , speed up innovation , and make our sites and apps more piquant , more personalized and more rewarding for all . Despite challenge over the past twelvemonth , I ’m optimistic about BuzzFeed ’s trajectory in 2024 . I believe we have a terrific chance in front of us to build the determine media company for the AI era . ”

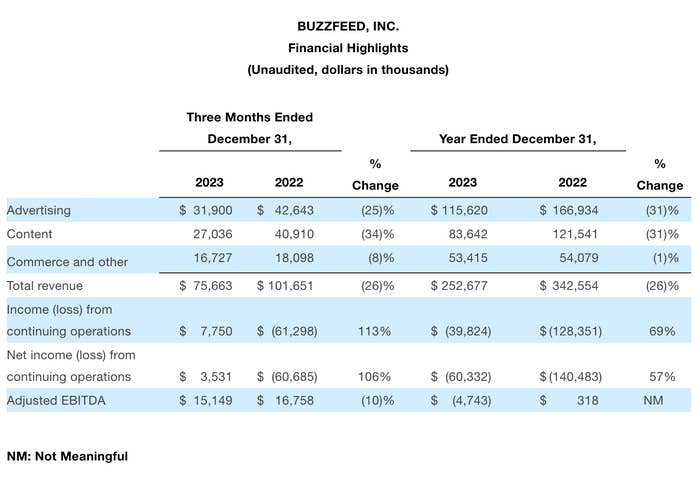

2023 Full Year Financial and Operational Highlights for Continuing Operations(excluding Complex )

Fourth Quarter 2023 Financial and Operational Highlights for Continuing Operations(excluding Complex)1

First Quarter 2024 Financial Outlook

These statements are ahead - looking and real result may differ materially as a result of many constituent . Refer to “ Forward - Looking statement ” below for information on component that could make our literal results to differ materially from these forward - looking statements .

Please see “ Non - GAAP Financial Measures ” below for a description of how Adjusted EBITDA is calculated . While familiarised EBITDA is a non - GAAP financial cadence , we have not provide guidance for the most directly like generally accepted accounting principles financial cadence — net income ( loss ) from continuing operation — due to the inherent difficulty in prediction and quantify sure amounts that are necessary to forecast such a measuring stick . consequently , a reconciliation of non - GAAP direction for familiarized Earnings Before Interest Taxes Depreciation and Amortization to the corresponding generally accepted accounting principles measure is not available .

Quarterly Conference Call

BuzzFeed ’s management team will throw a conference call to talk over our fourth quarter and full year 2023 results today , March 25 , at 5PM ET . The call will be available via webcast atinvestors.buzzfeed.comunder the head News and event , and party concerned in participating must register in advance at the same location . Upon enrolment , all telephone participant will receive a verification email detailing how to join the league call , including the telephone dial - in number along with a unparalleled PIN that can be used to enter the call . While it is not require , it is recommended you join 10 minute prior to the upshot start up time . A replay of the call will be made available at the same universal resource locator .

We have used , and intend to continue to use , the Investor Relations section of our website atinvestors.buzzfeed.comas a mean value of break real nonpublic information and for complying with our disclosure obligations under Regulation FD .

Definitions

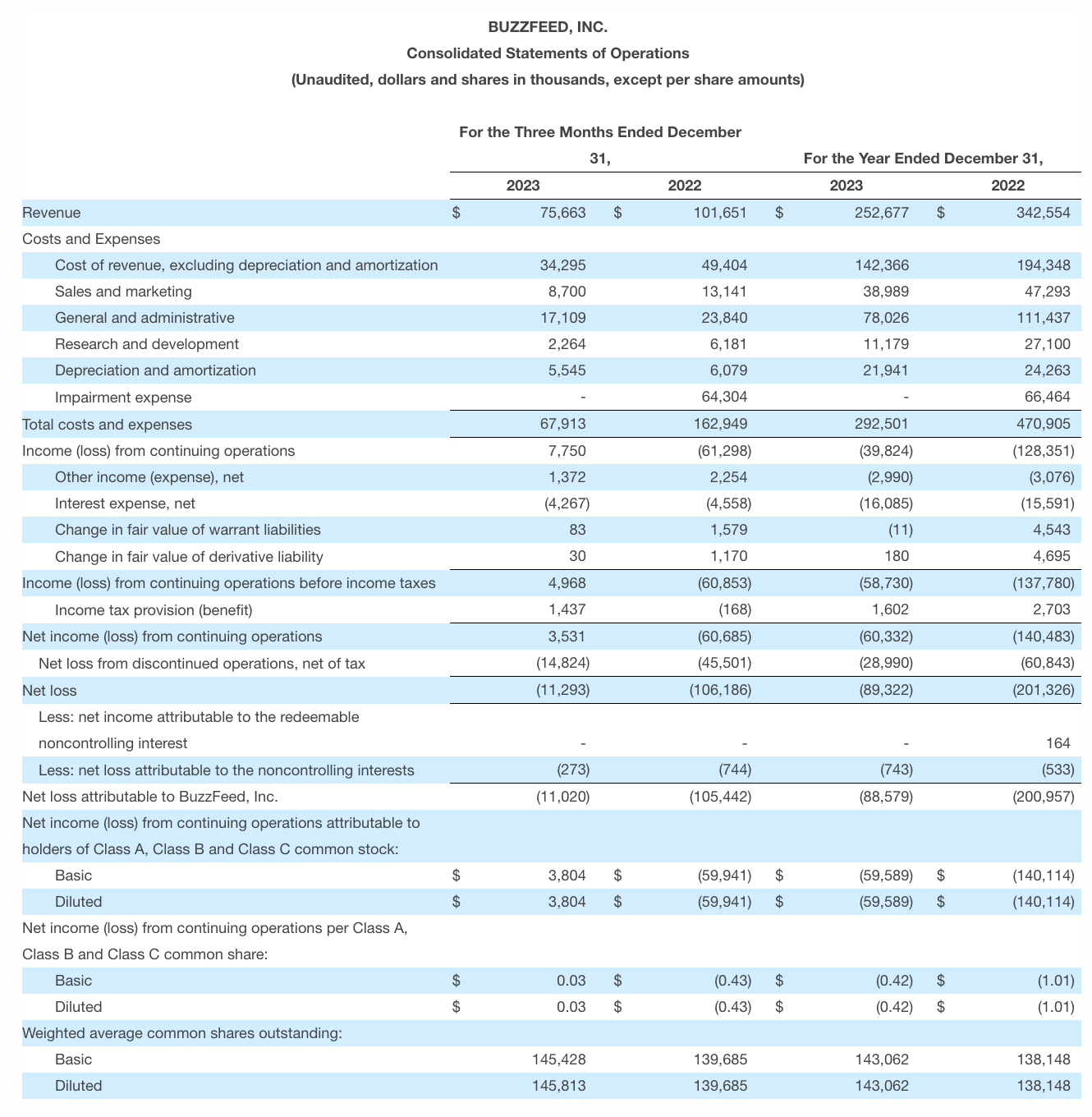

BuzzFeed report tax income across three primary occupation melodic phrase : Advertising , Content and Commerce and other . The definition of “ Time Spent ” is also set forth below .

About BuzzFeed , Inc.

BuzzFeed , Inc. is home to the better of the Internet . Acrosspop culture , entertainment , shopping , food and news , our brands aim conversation and exalt what audiences watch , interpret , and grease one’s palms now — and into the future . Born on the net in 2006 , BuzzFeed is committed to making it better : leave rely , lineament , brand - safe news and amusement to 100 of millions of the great unwashed ; making substance on the net more inclusive , empathetic , and creative ; and inspire our audience to last better lives .

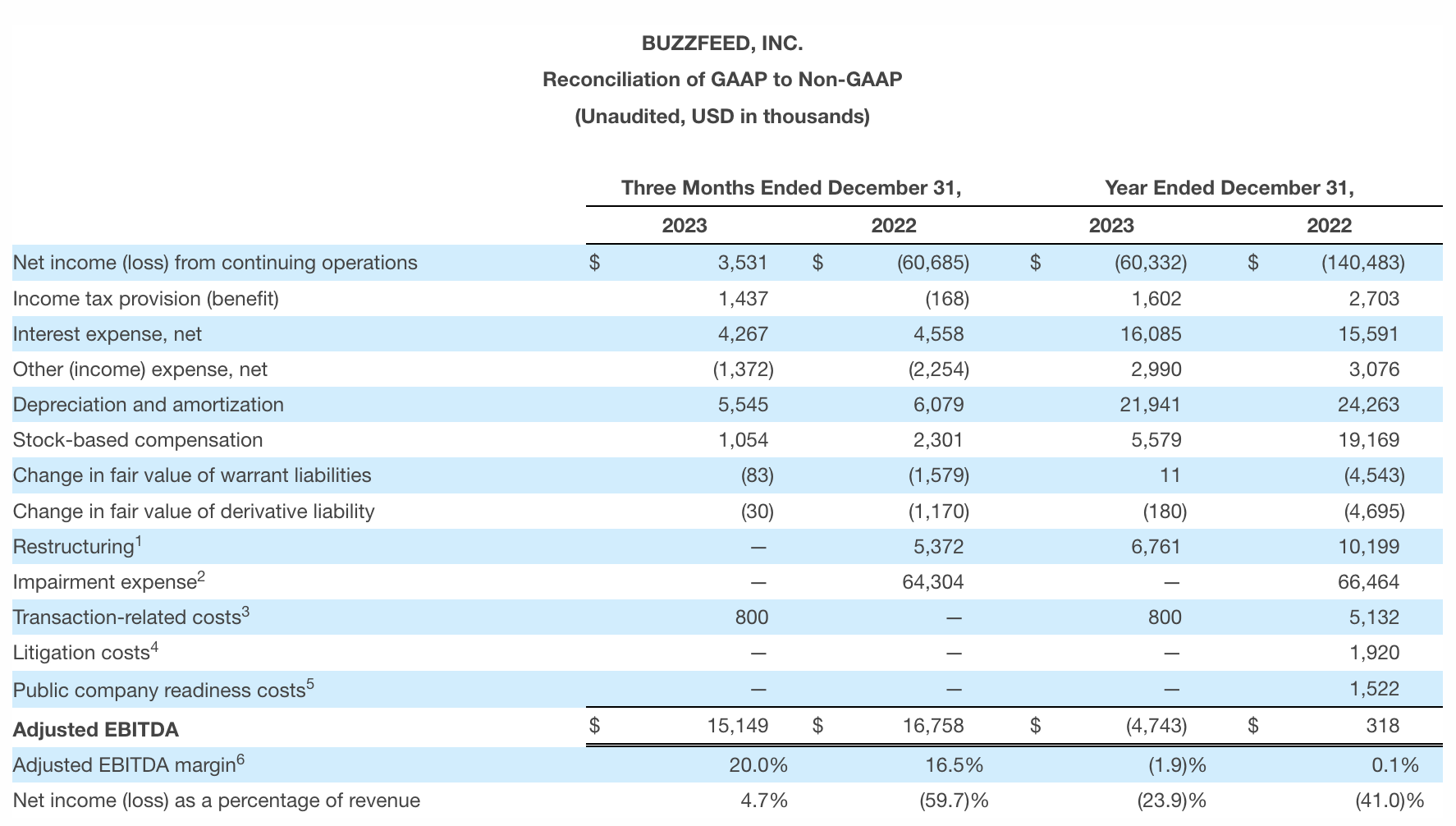

Non - GAAP Financial Measures

familiarised Earnings Before Interest Taxes Depreciation and Amortization and familiarized EBITDA margin are non - GAAP financial measures and represent key metrics used by direction and our board of directors to measure the operational strength and performance of our business , to shew budgets , and to develop operational goals for supervise our patronage . We define familiarized Earnings Before Interest Taxes Depreciation and Amortization as net income ( release ) from continuing operations , bar the impact of net ( exit ) income attributable to noncontrolling interests , income taxation provision ( benefit ) , interest expense , meshwork , other ( income ) expense , profit , disparagement and amortization , pedigree - based compensation , alter in bonnie time value of warrant financial obligation , change in fair note value of derivative liability , restructuring costs , impairment expense , transaction - touch costs , sure litigation costs , public company readiness toll , and other non - cash and non - revenant particular that direction believe are not suggestive of on-going operations . familiarised EBITDA tolerance is calculated by divide Adjusted Earnings Before Interest Taxes Depreciation and Amortization by receipts for the same period .

We believe Adjusted EBITDA and familiarized EBITDA margin are relevant and useful information for investor because they admit investors to consider performance in a way interchangeable to the method used by our management . There are limitations to the use of Adjusted Earnings Before Interest Taxes Depreciation and Amortization and familiarised EBITDA margin and our Adjusted EBITDA and familiarised EBITDA gross profit may not be like to similarly titled measures of other companies . Other companies , include companies in our diligence , may work out non - GAAP financial measures differently than we do , limiting the usefulness of those measures for relative purposes .

Adjusted Earnings Before Interest Taxes Depreciation and Amortization and familiarized EBITDA perimeter should not be considered a substitute for touchstone prepared in accordance of rights with GAAP . rapprochement of non - GAAP financial measures to the most straight comparable fiscal consequence as determined in accordance with generally accepted accounting principles are included at the terminal of this press liberation follow the accompanying fiscal data .

Forward - Looking Statements

sure statements in this press release may be considered forward - looking statements within the meaning of Section 27A of the Securities Act of 1933 , as remediate , and Section 21E of the Securities Exchange Act of 1934 , as amended , which statement require substantial risks and dubiety . Our forward - looking statements include , but are not limited to , statements regarding our direction team ’s expectations , hopes , beliefs , intentions or scheme regarding the future . In plus , any program line that consult to projections , prognosis ( including our mindset for Q1 2024 ) or other characterizations of future events or consideration , including any underlying assumption , are onward - looking statements . The words “ involve , ” “ anticipate , ” “ believe , ” “ can , ” “ ruminate , ” “ continue , ” “ could , ” “ figure , ” “ expect , ” “ prognosis , ” “ intend , ” “ may , ” “ might , ” “ architectural plan , ” “ potential , ” “ potential , ” “ augur , ” “ labor , ” “ seek , ” “ should , ” “ place , ” “ will , ” “ would ” and similar formula may key out forward - looking argument , but the absence of these words does not mean that a argument is not forward - front . The forward - look statements contained in this military press release are based on current expectations and beliefs concerning future developments and their potential effects on us . There can be no assurance that future developments affecting us will be those that we have anticipated . These forward - looking statements involve a number of risk , uncertainties ( some of which are beyond our control ) or other assumptions that may induce actual resultant role or carrying into action to be materially dissimilar from those expressed or implied by these forward - looking statements . These risks and uncertainty include , but are not limited to : ( 1 ) macroeconomic factors include : adverse economic consideration in the United States and globally , include the possible onset of recession ; likely government shutdowns or unsuccessful person to raise the U.S. Union debt ceiling ; current global supplying chain disruptions ; the ongoing battle between Russia and Ukraine and between Israel and Hamas and any related sanctions and geopolitical tensions , and further escalation of trade tensions between the U.S. and China ; the inflationary surround ; and the competitive labor market ; ( 2 ) developments relate to our competitors and the digital media industriousness , including overall demand of ad in the market in which we operate ; ( 3 ) demand for our products and services or changes in dealings or engagement with our brands and subject matter ; ( 4 ) changes in the clientele and competitory environment in which we and our current and prospective partners and advertiser mesh ; ( 5 ) our future cap demand , including , but not limited to , our ability to obtain additional capital in the future , to settle down conversion of our outstanding transmutable banknote , repurchase the notes upon a fundamental variety or repay the notes in hard currency at their maturity any restriction levy by , or commitment under , the indentation governing our unsecured Federal Reserve note or the facility regularise any future indebtedness , and any restrictions on our power to access our hard currency and cash equivalents ; ( 6 ) developments in the law and administration regulating , include , but not limited to , revise foreign substance and ownership regulations , and the consequence of sound proceedings , regulative difference of opinion or governmental investigations to which we are subject ; ( 7 ) the benefits of our restructuring ; ( 8) our success strip of company , assets or brands we betray or in integrating and hold up the company we acquire ; ( 9 ) technological developments including hokey word ; ( 10 ) our achiever in retaining or recruiting , or changes ask in , officer , other central employees or directors ; ( 11 ) enjoyment of substance creators and on - camera talent and family relationship with third parties managing certain of our post operation outside of the United States ; ( 12 ) the security system of our information technology systems or data ; ( 13 ) disruption in our armed service , or by our failure to timely and efficaciously descale and adapt our existing technology and substructure ; ( 14 ) our ability to maintain the itemisation of our Class A common origin and warrants on The Nasdaq Stock Market LLC ; and ( 15 ) those factors name under the section entitled “ Risk Factors ” in the Company ’s yearly and quarterly filings with the Securities and Exchange Commission .

Should one or more of these peril or incertitude materialise , or should any of our assumptions prove incorrect , actual results may vary in material respectfulness from those projected in these forward - looking program line . There may be additional risks that we consider indifferent or which are unknown . It is not possible to foretell or identify all such peril . We do not contract any obligation to update or revise any forward - looking statement , whether as a event of new data , future events or otherwise , except as may be required under applicable securities jurisprudence .

#

Contacts

Media Contact

Juliana Clifton , BuzzFeed:juliana.clifton@buzzfeed.com

Investor Relations Contact

Amita Tomkoria , BuzzFeed:investors@buzzfeed.com

( 1 ) We exclude restructuring disbursement from our non - GAAP measures because we believe they do not reflect wait future operating expenses , they are not indicative of our core operating performance , and they are not meaningful in comparing to our past operating performance .

( 2 ) reflect aggregate non - cash impairment expense memorialize during the class ended December 31 , 2022 tie in with goodwill impairment of $ 64.3 million and $ 2.2 million related to certain long - live assets of our former corporate headquarters , which was fully sublet during the third poop of 2022 .

( 3 ) reflect dealing - related costs and other items which are either not representative of our underlie operations or are incremental costs that leave from an actual or contemplated dealings and admit professional fees , integration expenses , and certain price related to integrating and converging IT systems .

( 4 ) Reflects price related to litigation that are outside the ordinary course of our business . We believe it is useful to leave out such charges because we do not consider such amounts to be part of the on-going operations of our business and because of the rum nature of the claims underlying the thing .

( 5 ) reflect one - time initial set - up costs tie in with the establishment of our public company complex body part and outgrowth .

( 6 ) final income ( loss ) as a percentage of revenue is include as the most comparable generally accepted accounting principles measure to familiarised EBITDA tolerance , which is a Non - generally accepted accounting principles measure .