ship’s company Completes Transformation to O&O - Led Platform . Flagship BuzzFeed Properties Show former Momentum with 3 % growing In Direct Traffic Versus Q4 .

NEW YORK– May 13 , 2024 - -BuzzFeed , Inc1 . ’s ( Nasdaq : BZFD ) reported first quarter ( ended March 31 , 2024 ) financial results in line with the society ’s outlook shared on March 25 , 2024 .

“ We closed the first twenty-five percent of 2024 with exciting impulse in our business , fill out the biggest whole step in our transformation , which was to refocus the company on our owned and manoeuvre sites and apps , and away from the chopine - dependent model of distribution,”saidJonah Peretti , BuzzFeed Founder & CEO.“Today , our direct audience is our large source of traffic to BuzzFeed ’s site and apps , and this audience is growing , which represents a vast chance for us to drive deeper participation with several raw content enterprisingness in our pipeline . ”

Peretti retain , " Our flagship BuzzFeed marque continues to guide digital medium in clip expend . We ’re poised to further extend this leadership with the consolidation of AI , driving both creative storytelling and the organic evolution of our job . "

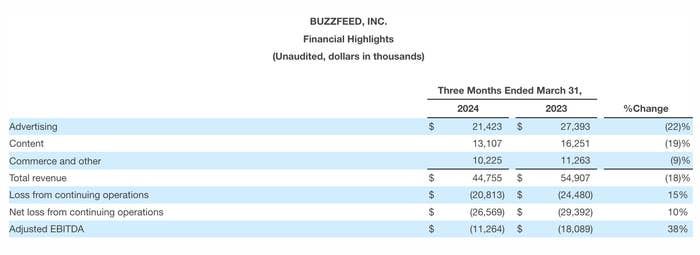

First Quarter 2024 Financial and Operational Highlights for Continuing Operations(excluding Complex)2

First Quarter 2024 Business and Content Highlights

Second Quarter 2024 Financial Outlook

These statements are forward - reckon and literal results may dissent materially as a result of many ingredient . Refer to “ Forward - Looking argument ” below for information on divisor that could cause our actual results to differ materially from these forward - calculate statements .

Please see “ Non - GAAP Financial Measures ” below for a description of how familiarised Earnings Before Interest Taxes Depreciation and Amortization is forecast . While Adjusted EBITDA is a non - GAAP fiscal measure , we have not provided counsel for the most directly comparable GAAP financial measure — net income ( loss ) from continuing cognitive operation — due to the built-in difficulty in prognostication and quantifying sure amounts that are necessary to forecast such a mensuration . consequently , a reconciliation of non - GAAP guidance for familiarised Earnings Before Interest Taxes Depreciation and Amortization to the gibe GAAP measure is not available .

Quarterly Conference Call

BuzzFeed ’s direction squad will take a league call to hash out our first quarter 2024 results today , May 13 , at 5PM ET . The call will be available via webcast atinvestors.buzzfeed.comunder the head News and event , and parties interested in participating must register in advance at the same emplacement . Upon enrollment , all telephone participants will receive a confirmation e-mail detail how to link the conference call , including the dial - in number along with a unequaled PIN that can be used to get at the call . While it is not required , it is commend you get together 10 minutes prior to the event start prison term . A rematch of the call will be made available at the same URL .

We have used , and intend to continue to utilize , the Investor Relations section of our website atinvestors.buzzfeed.comas a means of bring out substantial nonpublic information and for complying with our disclosure obligations under Regulation FD .

definition

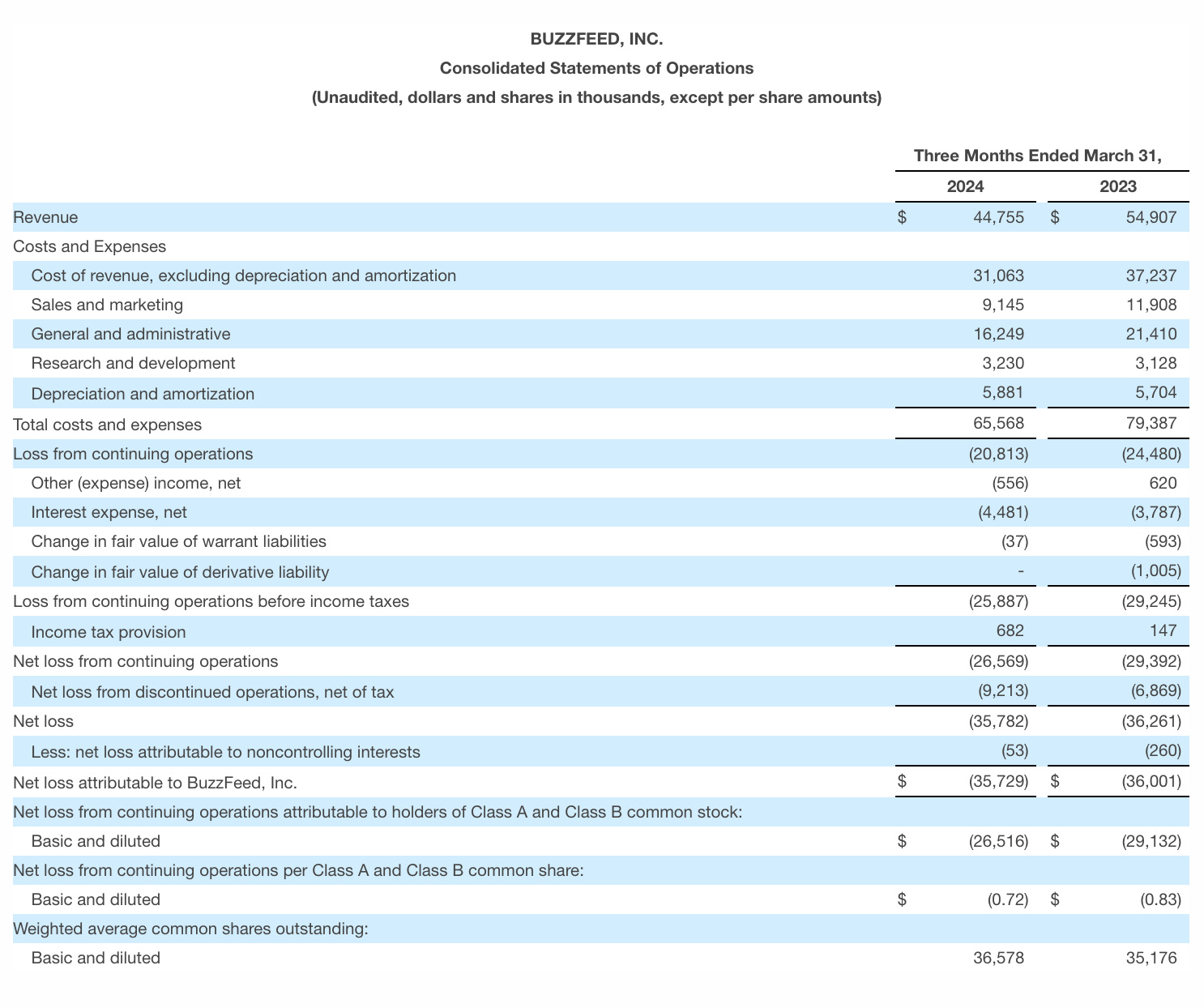

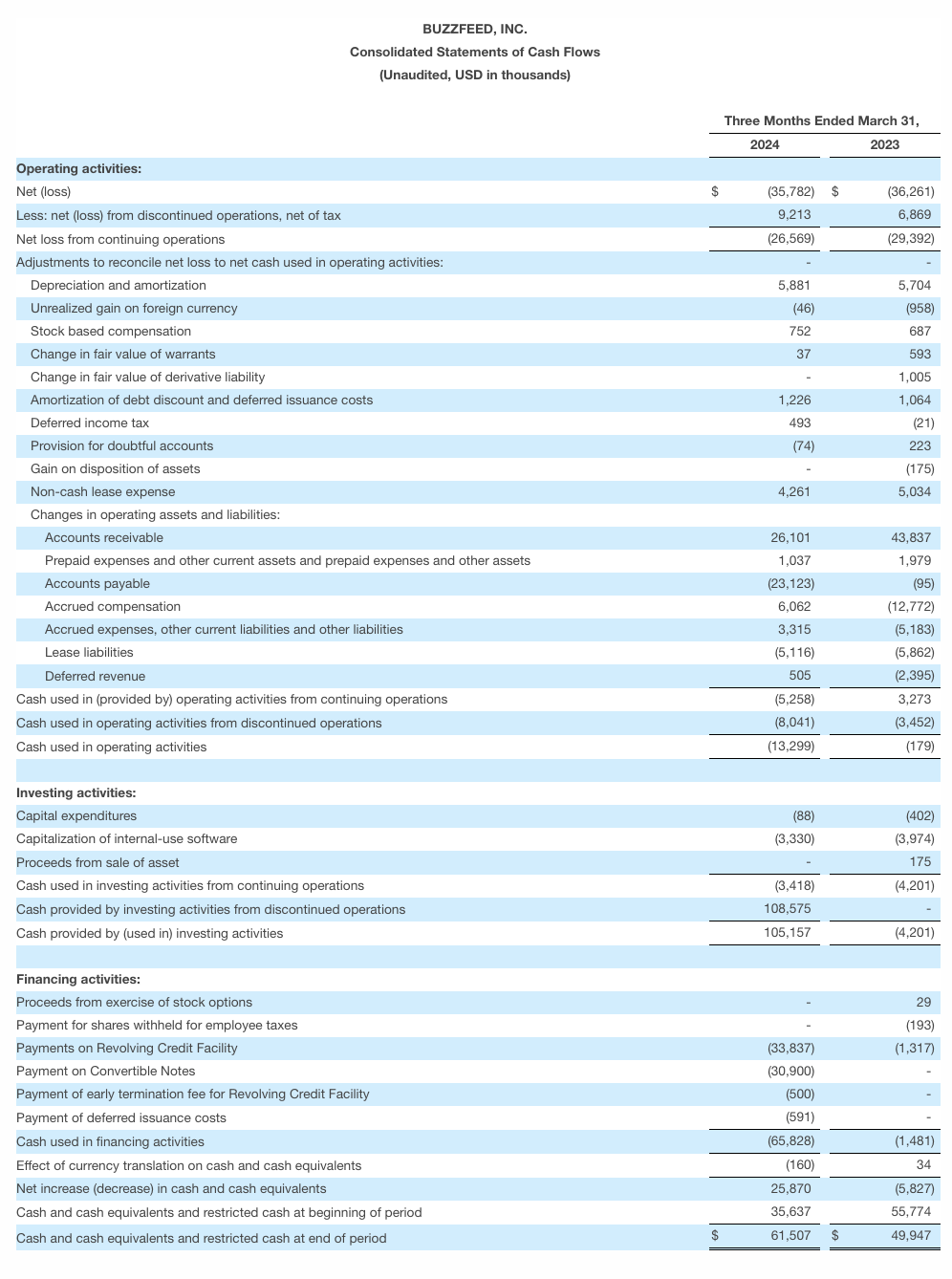

BuzzFeed account revenues across three primary business lines : Advertising , Content and Commerce and other . The definition of Time Spent is also countersink forth below .

About BuzzFeed , Inc.

BuzzFeed , Inc. is home to the best of the Internet . Acrosspop culture , entertainment , shopping , food and news , our brands beat back conversation and inspire what audience watch , understand , and buy now — and into the future . carry on the cyberspace in 2006 , BuzzFeed is committed to making it better : providing trusted , quality , brand - dependable word and entertainment to hundreds of millions of mass ; induce content on the Internet more inclusive , empathetic , and originative ; and inspire our audience to live better lives .

Non - generally accepted accounting principles Financial Measures

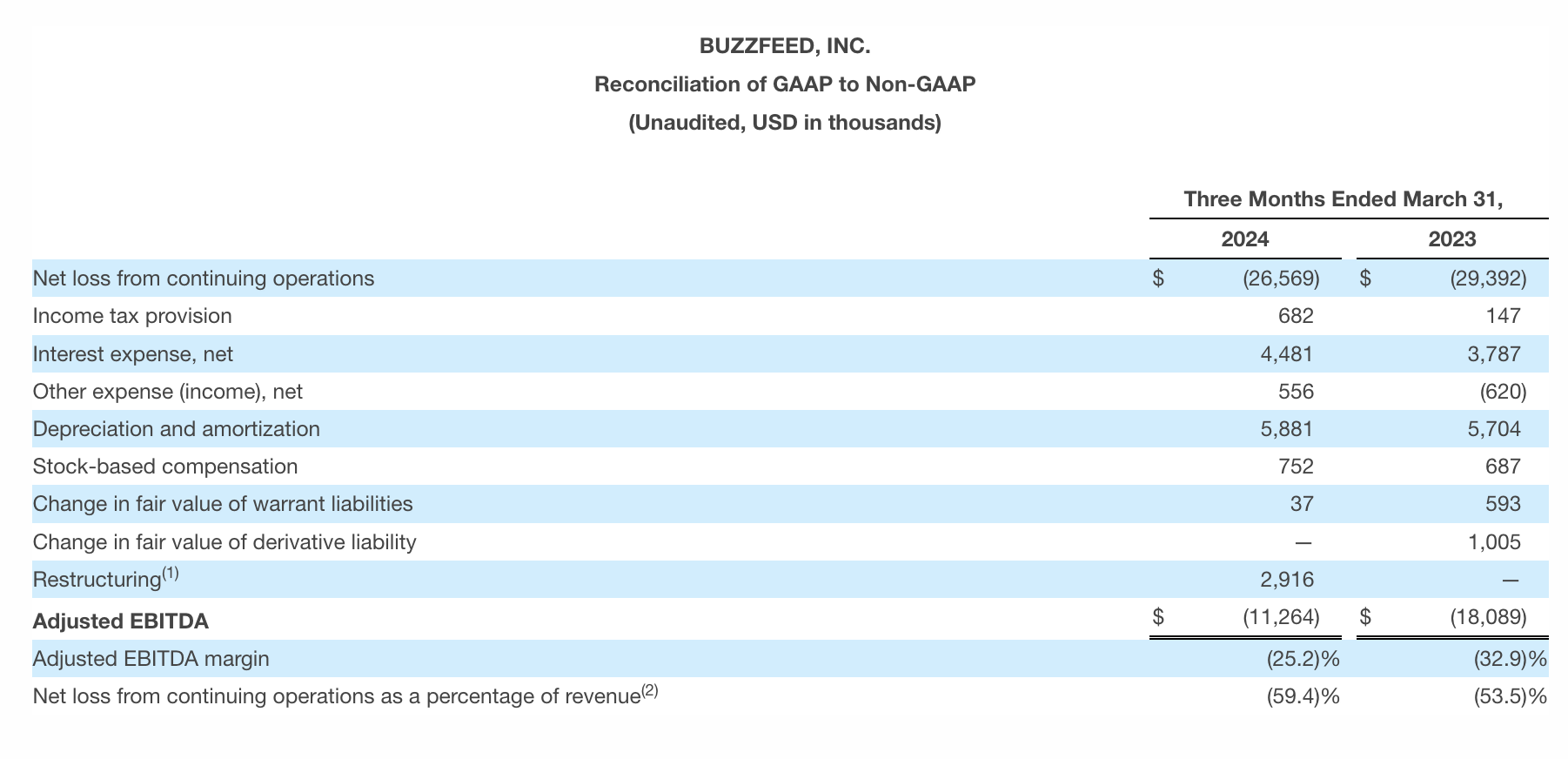

familiarized EBITDA and familiarized EBITDA allowance are non - GAAP fiscal measures and map central prosody used by management and our board of directors to assess the operational strength and performance of our business , to found budget , and to develop operational goals for managing our business . We define Adjusted EBITDA as net expiration from stay on process , excluding the impact of nett loss attributable to noncontrolling interest , income tax provision , interest expense , net , other disbursal ( income ) , cyberspace , depreciation and amortization , store - based compensation , interchange in comely economic value of warrant liabilities , change in fair value of derivative liability , restructure costs , and other non - cash and non - recurring detail that direction believes are not declarative of ongoing operations . familiarised EBITDA gross profit margin is calculated by separate familiarized Earnings Before Interest Taxes Depreciation and Amortization by revenue for the same period .

We believe familiarised Earnings Before Interest Taxes Depreciation and Amortization and familiarized Earnings Before Interest Taxes Depreciation and Amortization allowance are relevant and utile data for investor because they appropriate investor to view performance in a manner similar to the method used by our management . There are limitation to the use of Adjusted EBITDA and Adjusted EBITDA leeway and our Adjusted EBITDA and Adjusted EBITDA margin may not be comparable to similarly entitle measures of other caller . Other companies , include companies in our industriousness , may aim non - GAAP financial measures otherwise than we do , limiting the usefulness of those bar for relative purposes .

Adjusted Earnings Before Interest Taxes Depreciation and Amortization and Adjusted EBITDA security deposit should not be considered a substitute for measure prepared in accordance with GAAP . reconciliation of non - GAAP financial measures to the most directly comparable financial resultant role as watch in accordance with GAAP are let in at the end of this press release following the company financial datum .

Forward - Looking affirmation

Should one or more of these risks or uncertainness materialise , or should any of our assumptions prove wrong , actual event may vary in material respects from those design in these fore - front statements . There may be additional risks that we consider immaterial or which are unnamed . It is not possible to predict or key all such risks . We do not take in charge any obligation to update or revise any forward - looking statements , whether as a result of fresh entropy , succeeding events or otherwise , except as may be required under applicable securities laws .

1 " BuzzFeed ” or the “ Company”2 The Company determined the plus of Complex Networks , shut out the First We Feast blade , foregather the classification for “ withstand for sales event . ” Additionally , the Company conclude the disposal , which occurred on February 21 , 2024 , represented a strategic chemise that had a major effect on our cognitive process and financial results . As such , the historical fiscal results of Complex Networks have been think over as discontinued operations in our condensed amalgamated financial statements . Amounts acquaint throughout this press spillage are on a continuing functioning basis ( i.e. , excluding Complex Networks).3 Adjusted Earnings Before Interest Taxes Depreciation and Amortization is a non - GAAP financial amount . Please refer to “ Non - GAAP Financial Measures ” below for a verbal description of how it is calculated and the tables at the back of this net income release for a balancing of our generally accepted accounting principles and non - GAAP results.4 Excludes Complex Networks and First We Feast ; see definition of “ Time Spent ” below .

( 1 ) We exclude restructuring expenses from our non - GAAP measures because we conceive they do not reflect expected future operating disbursement , they are not indicative of our core operating performance , and they are not meaningful in comparison to our preceding operating performance .

( 2 ) Net loss from continuing operations as a percentage of revenue is include as the most comparable generally accepted accounting principles measure to familiarised EBITDA gross profit margin , which is a Non - GAAP measure .

contact

MediaJuliana Clifton , BuzzFeed:juliana.clifton@buzzfeed.com

Investor RelationsAmita Tomkoria , BuzzFeed:investors@buzzfeed.com